Most employees are trustworthy, but even one bad apple can wreak havoc on your bottom line and company’s reputation. In one organization, an employee stole $6M operating a side business while another used $4.1M in corporate credit card transactions to build a music studio. While these examples may sound outrageous, American corporations lose approximately $50B and 1.8% in revenue annually because of employee fraud.

Watch the on-demand webinar to learn how Finance AI can help you manage expense risk and root out fraud before it cripples your business.

- Explore autonomous expense tracking and how it can find and prevent employee fraud across T&E, Accounts Payable, and P-Cards.

- Discover the many benefits of autonomous expense tracking over manual review.

- Learn how AI-driven analytics using unstructured expense data gives you the power to spot real-time and potential fraudulent spend.

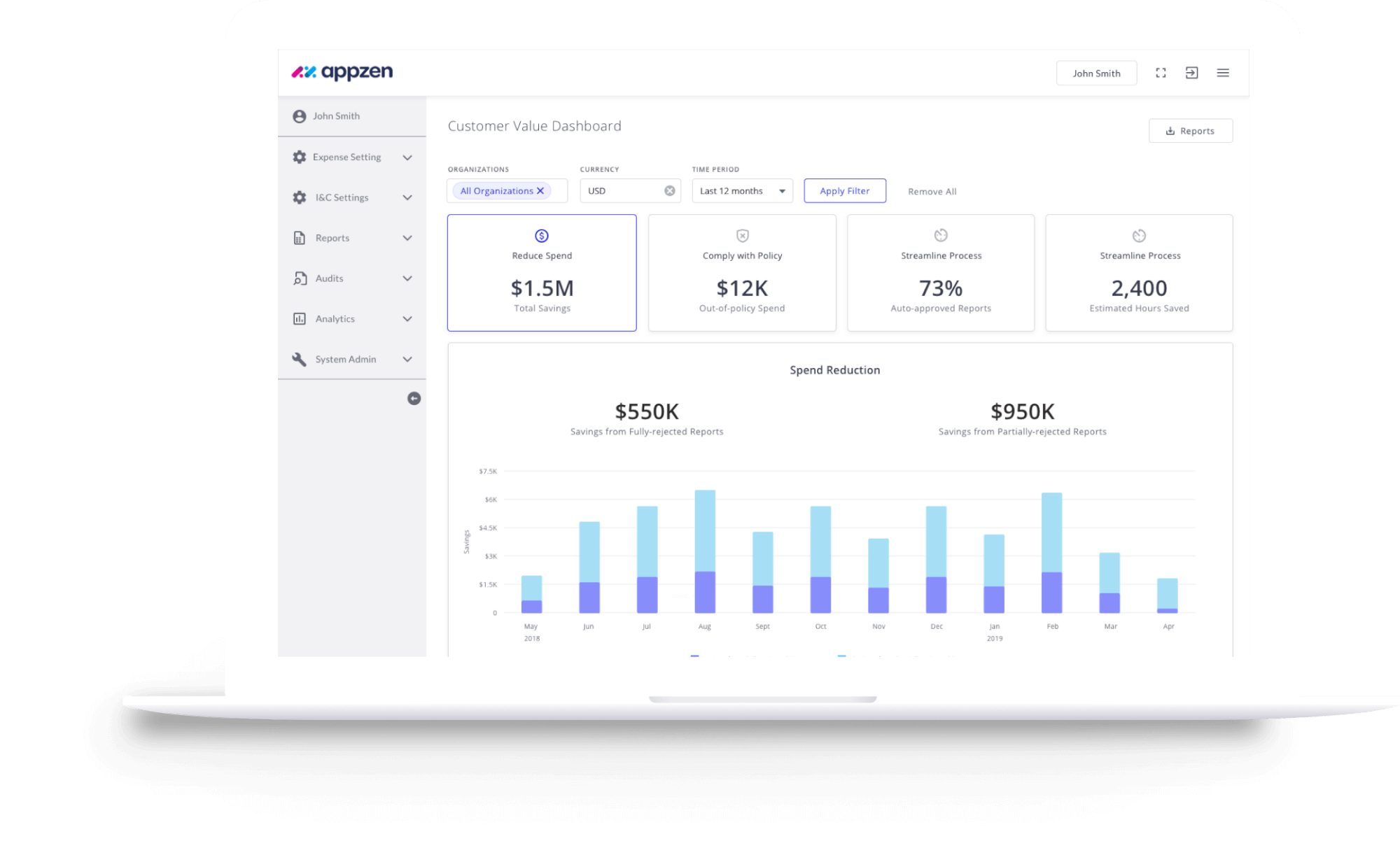

- See examples of Finance AI technology identifying and eliminating real-world fraudulent transactions, and delivering unbeatable value for customers.

Instantly audit 100% of expenses before you pay them and ensure all expense reports are compliant with our Expense Audit solution

Related resources

Data Sheets

Sunshine Act compliance: How AppZen can help

More

Data Sheets

AppZen Inbox: Generative AI for your AP emails

More

Data Sheets

Autonomous, AI-driven invoice data capture

More

Data Sheets

Platform brief: Autonomous spend-to-pay processing

More

Data Sheets

Team Insights data sheet

More

Data Sheets

Spend Audit: Finance AI that audits 100% of your spend

More

Data Sheets

Autonomous AP: AI-Powered solutions for your AP inbox

More

Data Sheets

Expense Audit: Instantly audit all your expenses with finance AI

More

Data Sheets

Are you a digital CFO?

More

Data Sheets