Mastermind AI Automation Platform

Build smarter finance workflows powered by AI

Combine your expertise with our AI automation platform for greater business impact, improved decision-making, and more time for work that drives business value.

“We’ve reached 75 to 80% autonomous. Now that my team members are not spending time on more repetitious tasks like data entry review, [they] spend time chasing discrepancies. Where advanced AI meets performance needs, it opens up new possibilities for workplace creativity.”

Multiply your teams’ impact

Extend their expertise with the most comprehensive AI platform for finance automation

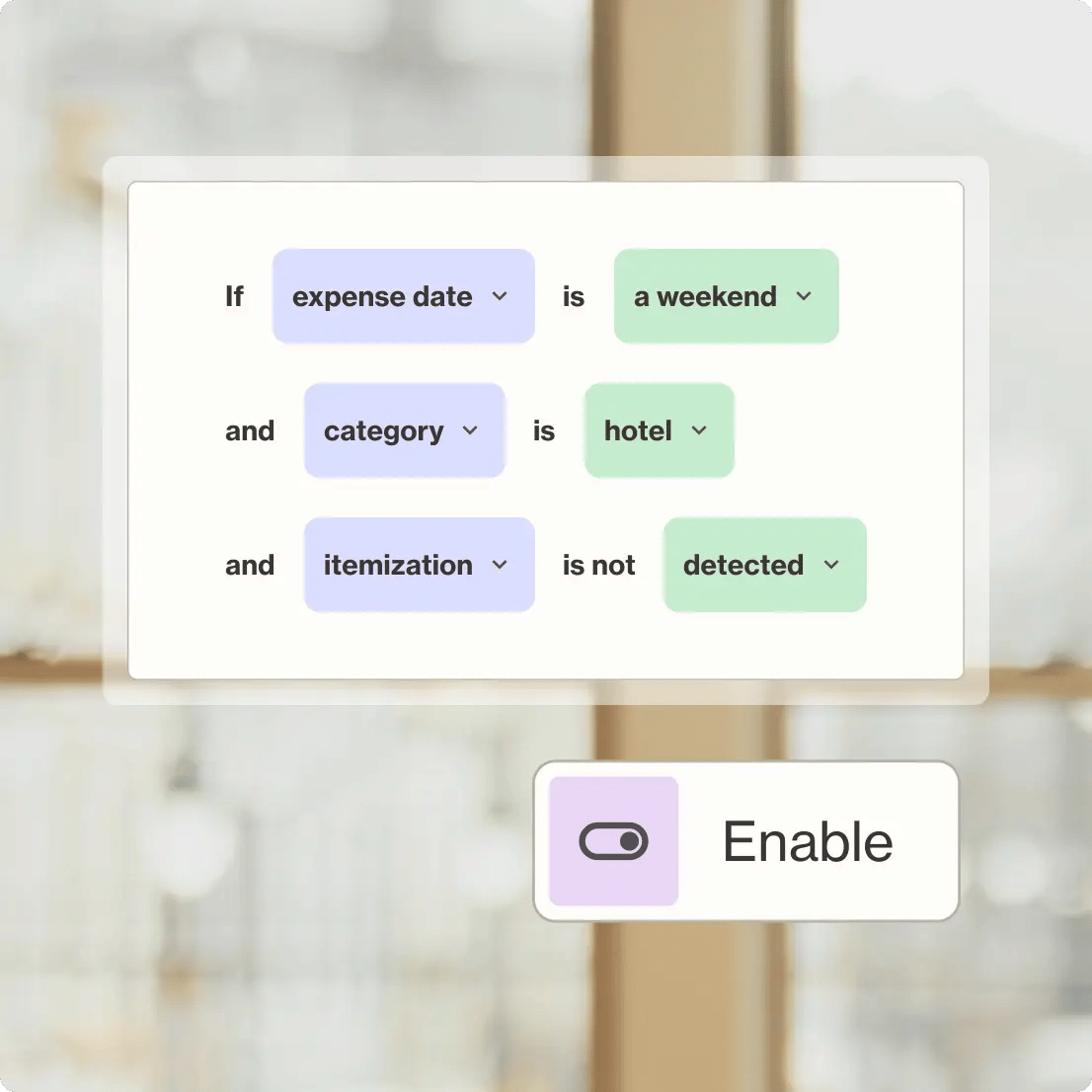

Automate without code

Now your finance experts can transform process knowledge into automated workflows without coding or IT support, and systematically automate the manual tasks in their SOPs.

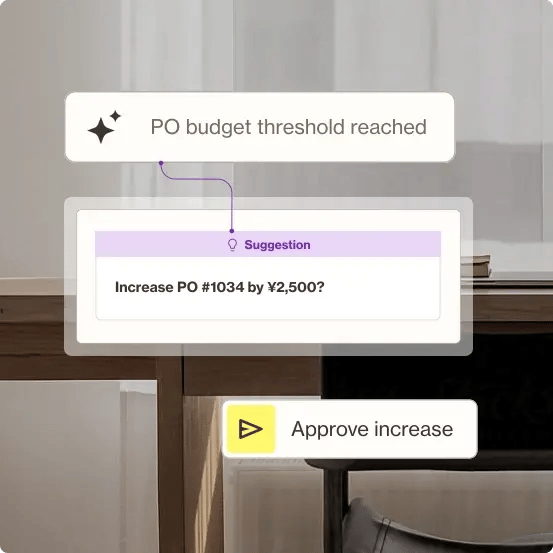

Deploy AI Agents

Build AI Agents to work alongside you 24/7 and handle complex, multi-step tasks by gathering data, making decisions, and taking action, like any new teammate.

AI Analytics

Quickly spot spending patterns and surface opportunities that support strategic decisions. Confidently present data-backed recommendations that executives can act on immediately.

Launch Pre-built Apps

Our library of specialized applications, built from real finance experience, lets your team quickly adopt best practices for common scenarios.

Finance Worker Model

Automate routine finance tasks

Complete complex, specialized tasks with high accuracy

TRANSFORMED PROCESSES

- Processing invoices

- Matching POs

- Predicting GL codes

- Validating receipts

- Performing detailed compliance checks

User Interaction Models

Communicate clearly

Write email replies and spend analyses; recommend policies

TRANSFORMED PROCESSES

- Writing vendor replies

- Manager notifications

- Process explanations

- Offering guidance based on AI analysis

Document Understanding

Capture document data

Gather and validate data in every language and in any document layout

TRANSFORMED PROCESSES

- Accurately reading and verifying invoices

- Receipts

- Statements

- Sign-in sheets

- Hotel folios

- Missing receipt affidavits

- Card transactions

Semantic Understanding Models

Accurately categorize

financial data

Contextualize and categorize documents, transactions, and written communications

TRANSFORMED PROCESSES

- Accurately classifying vendor spend

- Accurately classifying employee spend

- Sorting and labeling emails

- Sorting and labeling invoices

- Sorting and labeling documents in multiple languages

Feedback Models

Optimize and improve Al assistants

Refine and improve based on user feedback and performance metrics

TRANSFORMED PROCESSES

- Learning based on team interactions

- Learning based on completed tasks

- Optimizing based on team interactions

- Optimizing based on completed tasks

Process Insights

Improve processes with Al analysis

Identify and share spend patterns; recommend policy changes

TRANSFORMED PROCESSES

- Delivering actionable analyses of expense audit configurations

- Delivering actionable analyses of team spend behaviors

- Delivering actionable analyses of vendor transactions

Ready to augment your

team’s capabilities?

See how these specialized AI models can help your finance team do more.

Our pre-built integrations

Your financial system is your source of truth. AppZen’s integrations seamlessly match your setup for automated processing that keeps your existing system running smoothly.

Trusted by global enterprise companies

Securely drive process improvements

Innovate confidently, knowing your team is always in control of their data, with a platform that meets the strictest security requirements of global financial institutions.

FAQs

01 What is the Mastermind AI Automation Platform?

The Mastermind AI Automation Platform is AppZen’s AI platform for spend automation and compliance. Its proprietary AI models eliminate manual intervention and automate decision-making for accounts payable and travel and expense operations. Our platform allows your finance team to create business process automations tailored to your specific requirements so you can reduce spend, improve compliance, create efficiencies, and grow the business–all without the cost of ownership typically associated with legacy, enterprise-class software systems.

02 What are the benefits of a single platform for spend automation and compliance?

The Mastermind AI Automation Platform allows you to access AI that automates standard operating procedure workflows, without coding or IT support. It helps accounts payable teams automate the entire invoice lifecycle with intelligent invoice capture and coding, smart approval workflows, automated PO matching, and e-invoicing. It also helps expense auditors de-risk wasteful spending by stopping duplicate payments, catching suspicious activity, and identifying policy change improvements. With a single platform, all your important information can be found in one place, making it easier to catch compliance issues, find critical data, and focus on what matters most, all from one, straightforward system.

03 What are AI Agents?

AI Agents are digital assistants that do more than follow simple commands. They can understand what you're trying to do, learn from past experiences, and handle complicated tasks with multiple steps. AppZen’s AI Agents are skilled in accounting and auditing so you can deploy them anywhere in your processes to work alongside you. Our AI Agents handle routine tasks, freeing your team to perform value-adding activities