Why AppZen

Achieve more with the proven leader in finance AI

Save time, cut costs, and make smarter business decisions with confidence.

Innovation that sets you up for success

This is how modern finance operates

See how leading companies free their teams to drive strategic value.

Give your finance team an edge

Trusted by one-third of Fortune 500 companies, AppZen delivers a robust finance platform that integrates with your existing systems, saving time and resources while reducing errors, fraud, and compliance risks. With over a decade of expertise and proven results, AppZen empowers finance teams to lead proactively, scale effortlessly, and gain a strategic edge.

Proprietary AI solutions for finance

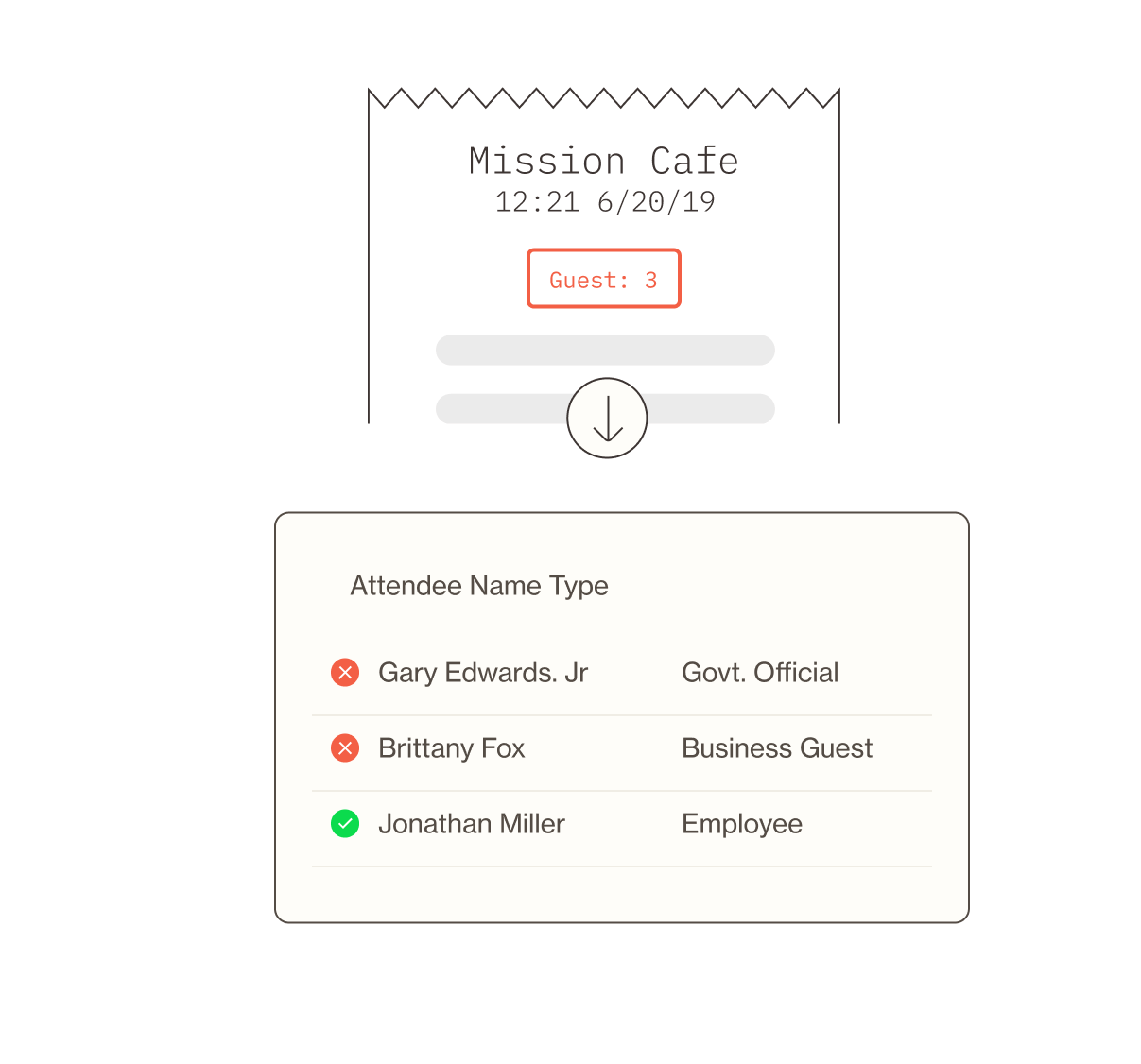

Our AI goes beyond automation—it predicts potential issues, identifies opportunities, and optimizes workflows for unmatched efficiency.

Tools that grow with your business

Our AI understands the context of financial documents, continuously learns from your data, and adapts to your unique needs.

End-to-end support

AppZen covers the entire spend-to-pay process, from email inbox management to invoice processing and expense auditing.

It's so easy to use! AppZen's tools and AI helps us tremendously with cross-checking and cross-referencing against our policies and compliances, and saves us [a] tremendous amount of time. We can download reports and benchmarks with a click of a mouse and filter as needed - but having that '1-click' function to download reports for all stakeholders has been beyond helpful. Our CSM partner and support team helps us with their insight, as they are the subject matter [experts] for their tool, we are able to strategically modify our workflow and benchmark. Absolutely fantastic and happy with AppZen's ease of implementation and ease of integration. We use AppZen daily.

Amy N.

I’ve been using Appzen for 2+ years now, and I’ve had an excellent experience with it. The software is incredibly user-friendly, making it easy to navigate even for someone who isn’t particularly tech-savvy. The interface is clean and intuitive, which significantly reduces the learning curve.

Enterprise User

Trusted by the best companies

Request a Demo

Want to see AppZen in action? Schedule a demo today to learn how we can revolutionize your bottom line.