A well-established, global bank achieved enhanced financial visibility and increased control with AppZen’s Expense Audit.

This leading financial institution with a global reach delivers comprehensive banking services across corporate, private, and investment sectors. It supports clients from individuals to multinational corporations and has a heritage of international banking dating back to 1870.

INDUSTRY

Financial Services

EMPLOYEES

10,000+

APPZEN PRODUCTS

Expense Audit, Custom models

INTRODUCTION

A well-established, global bank, with a solid infrastructure and services in all major emerging markets, thrives world-wide by earning the trust of every stakeholder, from the newest employee to the longest-standing client. It does so through its commitment to its core values, most notably those of integrity, sustainable performance, innovation, and discipline. Such a commitment requires that any strong, successful financial institution retain tight control over its finance back-office processes, especially its Travel & Expense (T&E) auditing.

THE CHALLENGE

The institution’s employees were sending in roughly 250,000 expense reports per year from countries all over the world. Before the bank approached Applen, its T&E processing was handled entirely through an outsourced audit service. Thorough audits across so many countries and languages required the administration of significant manual labor. This legacy service could not meet the bank’s high standards at scale because it could not overcome the problems inherent to manual processing: accuracy, efficiency, and cost.

Managing this audit team was time-consuming and difficult. Scripted questions given to outside auditors couldn’t cover every spend item. The lack of “common sense” checks to confirm whether an expense was truly business-related was problematic. The bank needed 100% certainty that wasteful, non-compliant, or fraudulent claims would not be paid. But fully auditing before payment was slow: electronic processing averaged 4 days and the paper process 22 days, from submission to payment.

The bank searched for a cost-effective, scalable, future-proof innovation that would provide high-quality service in line with its core values. The key to their final decision was Applen Expense Audit’s ability to audit every one of their expense claims before payment. With its multi-layered, artificial intelligence (Al) software, it was the right solution at the right time.

THE SOLUTION

The phased roll-out of Expense Audit covered dozens of countries. The bank began with its highest-volume regions, which allowed its project team to gain experience quickly. The team believed its headquarters country would be the most difficult deployment, and so saved that region for last.

The bank came to the table with considerable T&E experience. Its highly-structured human audit program made it easy to find the gaps that technology could fill. Paired with the knowledge and system configuration capabilities of AppZen’s T&E experts, the team created a solution that avoided implementation obstacles. The project team provided consistency and a steady learning curve as each phase was deployed, and they remained in place well after the solution went live.

AppZen’s understanding of the company’s culture helped accelerate the process. It provided well-thought-out short- and long-term plans. And it offered detailed training to help the bank’s project team feel confident as they prepared to centralize operations, walking them through the purposes and functions of each Al model, step-by-step. In this way, the project team gained a deeper understanding with each deployment; by the time they reached the final phase, they were able to roll out to the headquarters country without friction. The entire program was recognized by bank executives as one of the smoothest, most successful projects of its kind.

RESULTS AND BENEFITS

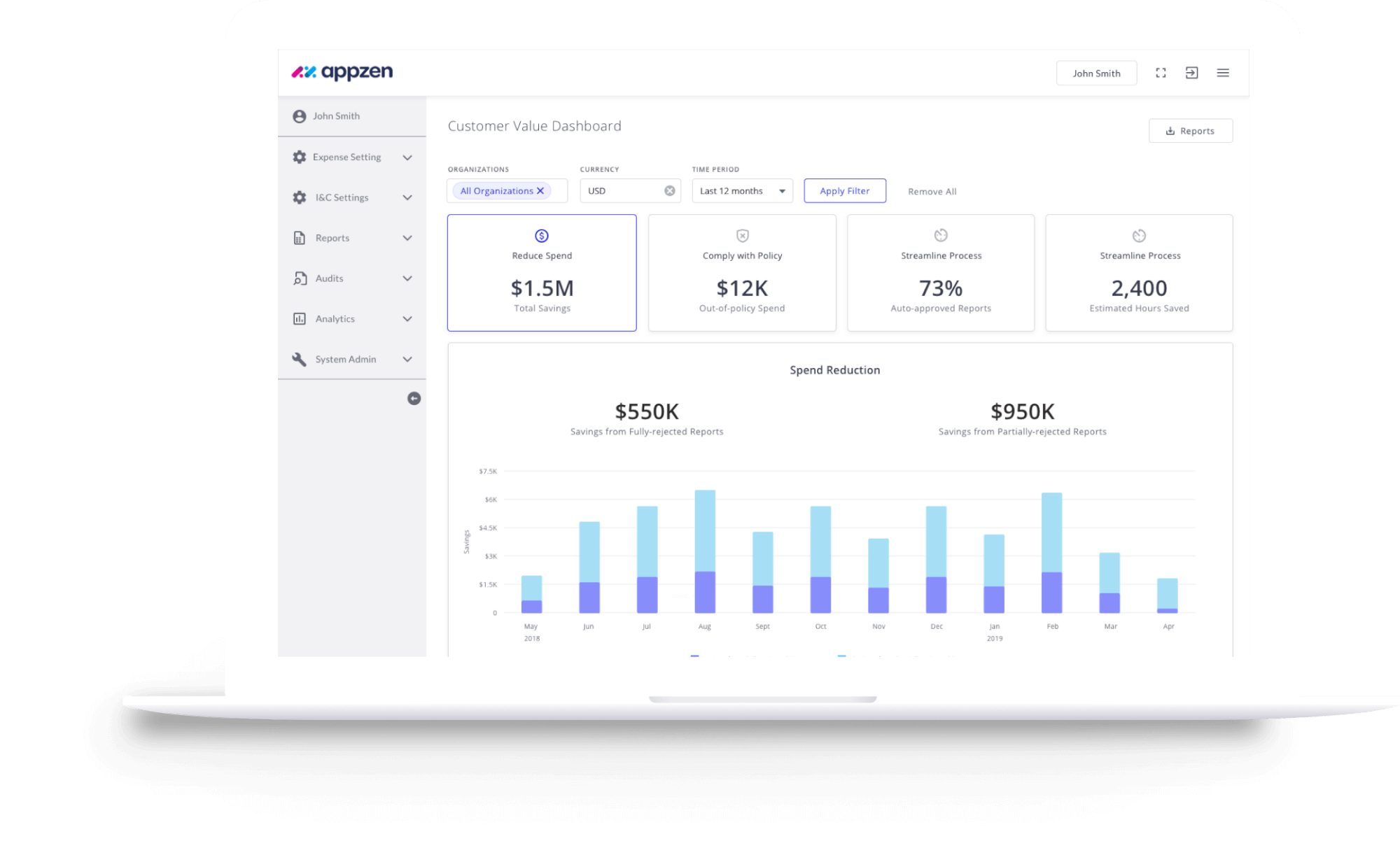

Rapid modernization of this global bank’s expense auditing function is a clear lesson in the benefits of shifting from a human-centric workflow to an Al-first operation. Expense Audit has allowed a handful of internal auditors to maintain tight control over data and operations. Well versed in the controls and compliance requirements a banking institution demands, this nimble, proficient group works across the entire organization to complete 100% of their audit and policy checks prepayment. With Expense Audit's dashboards, they can quickly access the data they need to pinpoint areas of concern and make rapid adjustments to policy and practice.

“Rapid modernization of this global bank’s expense auditing function is a clear lesson in the benefits of shifting from a human-centric workflow to an AI-first operation.”

Their new understanding of Al models also encouraged the project team to begin customizing the solution. Five custom models were built to suit their needs, which were subsequently made available to all Expense Audit customers through AppZen’s AppStore. With an “optimize forever” feeling of anticipation, the project team is eager to build in additional functionality around customized policy models.

Because the bank is now laser-focused on high-risk lines:

-

76% of all reports are auto-approved and take only minutes

-

Items requiring manual review average 0.83 days to audit

-

Every report is checked for compliance, prepayment, reducing risk

-

Rapid reimbursement has increased employee satisfaction

Retaining disciplined control over their expense data allowed the bank to continue to ensure high-quality service and satisfaction. And all of these benefits map back to its key corporate goals. True to its values, the bank can act with integrity as it sustainably scales its finance back-office performance with Expense Audit’s innovative finance Al.

Ready to learn more about how AppZen can help you?