AI Agent Studio

Build your hybrid finance team in minutes

Bring your work instructions to life as Al Agents, digital coworkers that handle repetitive finance tasks while your team focuses on strategy.

Turn your SOPs into AI-powered digital coworkers

What will finance look like in 2030?

Gartner outlines how AI agents, automation, and conversational interfaces will reshape finance operations and decision-making.

From SOPs to AI Agents in a few clicks

Upload your standard operating procedure documents or start with a best-practice template. The AI Agent Studio instantly assembles your AI Agent.

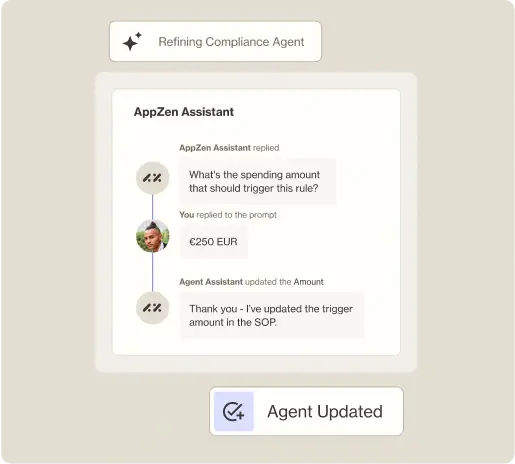

Finance expertise, built in

Describe the changes that need refining. The Agent updates your instructions and policies like a trusted finance advisor.

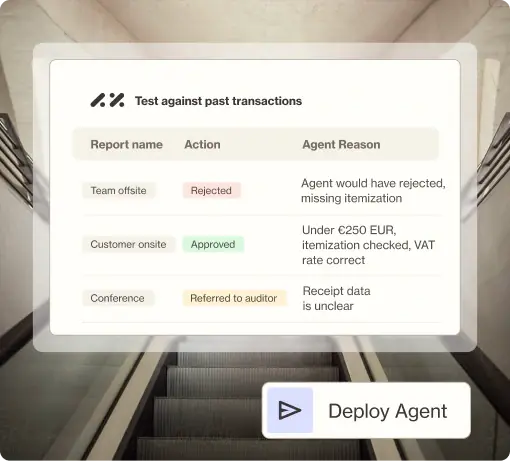

Prove it before you go live

Evaluate each Agent in a controlled environment against historical or live data, benchmarking its performance against your human experts before going live.

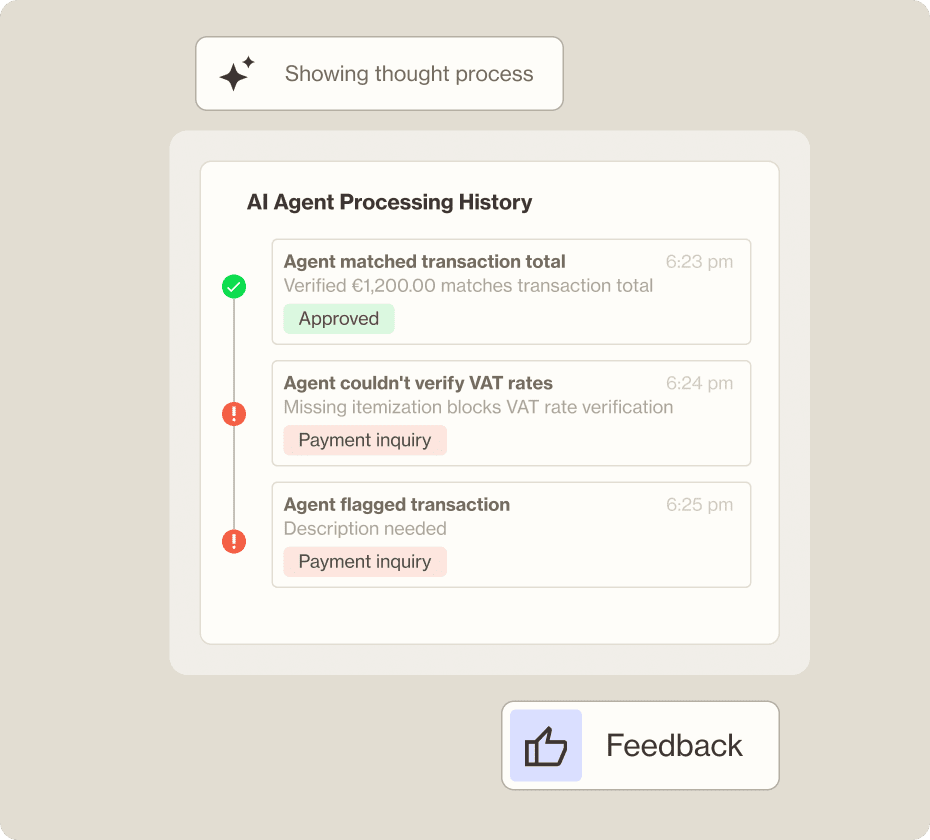

Explainable decisions, auditable outcomes

All Agent actions are visible, explainable, and fully auditable for governance, giving you transparency by design.

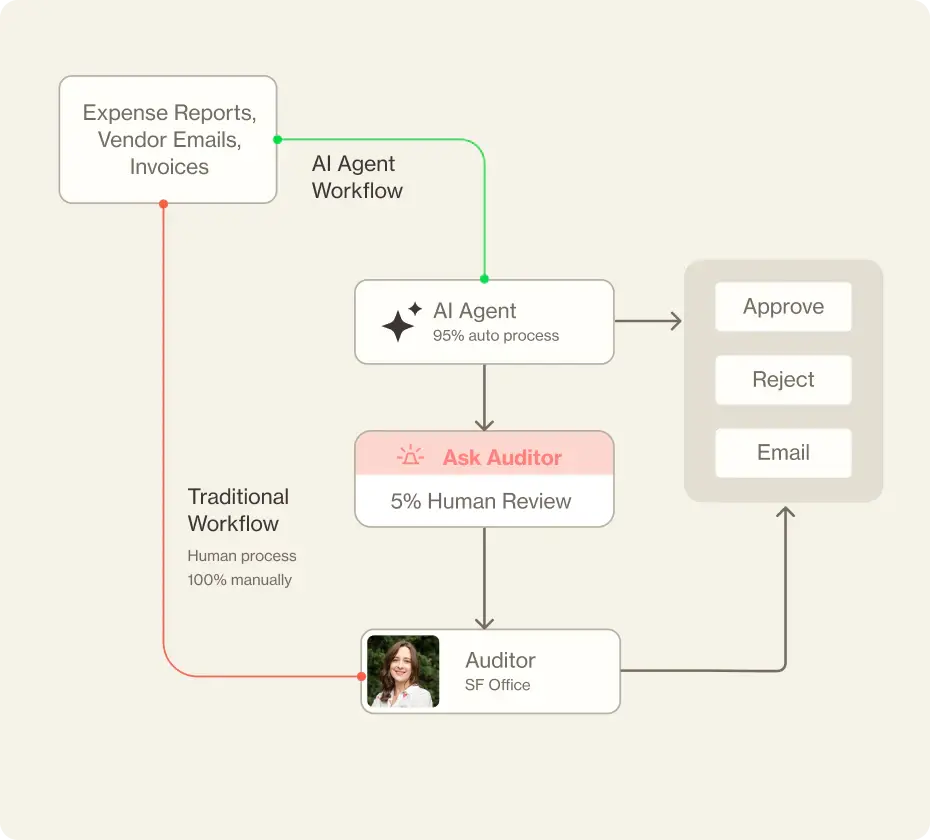

AI Agents that know when to ask for help

AI Agents escalate and assign tasks to human teammates when they lack the certainty to make a clear decision.

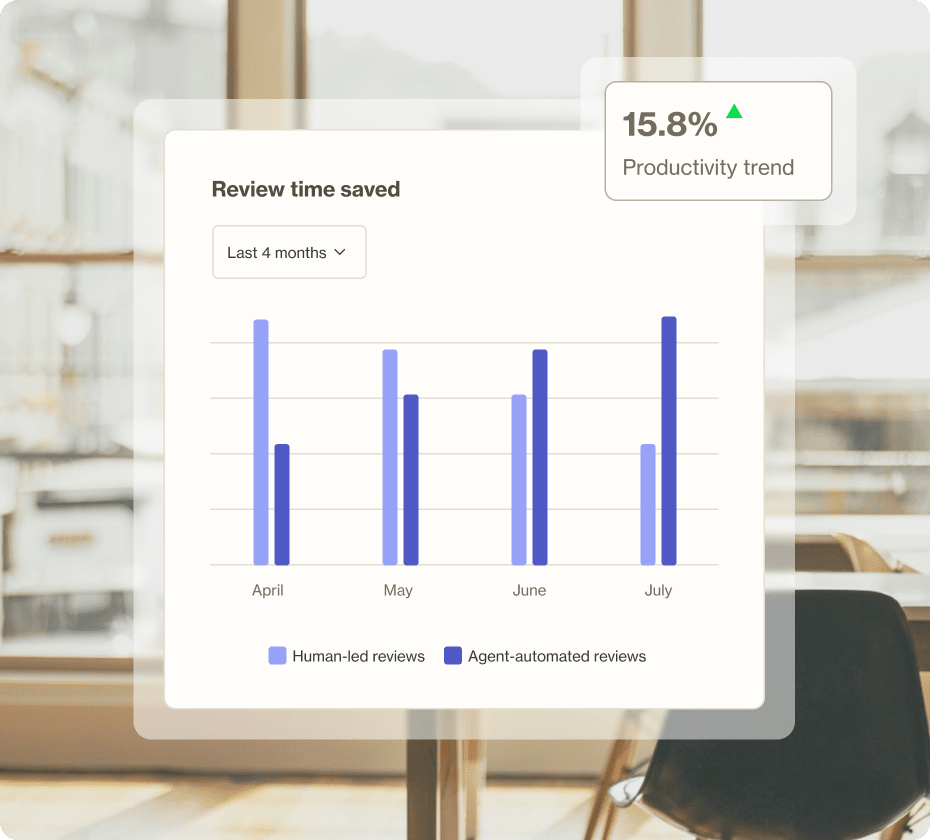

See the lift, not the hype

Dashboards reveal the cost, speed, and accuracy gains that your AI Agents deliver, pre- vs. post-activation.

Start with these proven SOP templates

Choose from ready-made Standard Operating Procedures, then customize them for your business

Within three weeks of going live, AppZen picked the PO number out of our master data when it was not present on the invoice, solely based on the fact that a copier serial number was on the invoice, and it was also in the PO data. It came into SAP and auto-posted without anybody ever touching it.

– AppZen customer testimony

AI Agent attributes

AI with tailored skillsets

Your feedback helps AI adapt to your specific workflow. Designed to complement your team’s expertise, it handles routine tasks like a trusted, personalized assistant.

Codeless configuration

Our point-and-click setup makes it easy for your team to ramp up quickly and be more productive, so they can spend more time on on strategic priorities.

Guide smarter decisions

Al Agents manage routine approvals and flag potential concerns, for improved insight into potential issues and more informed decisions.

Ready to build your first AI Agent?

AI Agent Studio Resources

FAQs

01 How are AI Agents being used in finance?

AI is transforming finance through intelligent automation and agentic frameworks, with AI Agent workflows that streamline operations across accounting, expense management, and financial planning. AI Agents, like those found within AppZen’s Mastermind AI Automation Platform, are now handling complex tasks like invoice processing, fraud detection, and compliance monitoring with unprecedented accuracy.

These advanced systems can analyze millions of transactions in real-time, identify spending patterns, and automatically flag policy violations, helping finance teams work more efficiently while reducing errors and risk.

02 Which AI Agents are the best for accounting and finance?

The best AI solution for accounting and finance depends on your specific business needs, but leading platforms that integrate AI Agents and machine learning capabilities offer the most comprehensive features.

AppZen’s AI Agents provide end-to-end automation of common tasks, real-time analytics, and customizable AI Agent workflows. The ideal solution should demonstrate proven accuracy in financial document processing, strong security measures, and seamless integration with existing accounting software and ERP systems.

03 What are finance AI Agents?

Specialized AI Agents that are part of finance AI platforms like AppZen’s offer more targeted and secure solutions for business finance needs.

AppZen's finance AI Agents are purpose-built systems incorporating domain-specific knowledge and compliance requirements that general-purpose AI cannot match.

Think of them like digital coworkers, trained to handle the complex, nuanced finance team activities that typically require human judgment, like coding invoices, validating expenses, detecting fraud, and checking compliance. Unlike traditional workflow software, which simply routes tasks, AppZen’s finance AI Agents read, reason, and take action to resolve those tasks.

Modern finance AI platforms use sophisticated AI Agent workflows to automate complex processes, ensure regulatory compliance, and provide detailed audit trails – capabilities that are essential for enterprise finance operations.

04 How are AppZen’s AI Agents different from legacy automation or RPA?

Rules-based, legacy automation and RPA follow static rules and scripts that quickly break when exceptions or policy nuances appear. AI Agents are built on finance-specific language models that can interpret unstructured data (PDFs, receipts, emails), apply policies with full context, and manage edge cases without escalation.

Unlike rigid workflows, AppZen’s AI Agents learn, adapt, and improve with every transaction. They are designed to replicate the decision-making of your best team members and scale it across your entire finance operation in a way that rules-based software simply cannot.

05 How do I build a finance AI Agent?

AppZen’s AI Agent Studio acts as a no-code AI agent builder. You start by writing a prompt or uploading your standard operating procedures (SOPs), made up of your team’s policies, rules, and process documents. The AI Agent Studio turns that knowledge into a working Agent that can follow the same steps your staff would.

Next, test it on real transactions in a safe environment, where you can compare its checks and validations to those of your human experts before launching it. Once live, the Agent begins work automatically, continuously learning from completed transactions and user feedback to keep improving over time.

06 Can AppZen’s AI Agents work with our existing finance systems?

Yes. AppZen’s AI Agents work seamlessly within AppZen's Mastermind AI Automation Platform, which integrates seamlessly with your existing finance systems. Instead of replacing your existing tech stack, AI Agents extend its value, reducing manual workloads, improving accuracy, and ensuring compliance without disruption.

07 Do AI Agents learn from our processes?

They do. AI Agents are trained on finance-specific data and policies, making it easy for them to understand your standard operating procedures (SOPs), and they continuously learn from your real-world transactions. They can capture the expertise of your best employees and replicate it consistently across the team.

AI Agent security features keep your data safely siloed within your own AI Agent Studio instance. For more on our safety and security features, check out our security web page or contact us for more details.

08 How quickly can we see value from AppZen’s AI Agents?

Most enterprises will see measurable ROI within weeks. Because AI Agents are pre-trained on global finance operations and compliance standards, they can deliver impact immediately and improve over time as they adapt to your business rules.

09 Are your AI Agents secure and compliant?

Yes. AppZen’s AI Agents are built with enterprise-grade security and compliance at the core, including data residency options in the US and EU. They automatically enforce finance policies, adhere to industry-specific regulations (like SOX, Sunshine Act, VAT, and more), and provide full audit trails for transparency.

10 Do AI Agents replace people?

No. AppZen’s AI Agents are designed to complement your finance team, not replace it. They handle repetitive, document-heavy work so your team can focus its expertise on strategic activities like forecasting, business partnering, and supplier relationships.