Accurately assigning general ledger (GL) codes for invoices that are missing purchase orders (POs) is harder than climbing Mt. Everest while holding your breath. From code category guessing games to outright embezzlement, the accuracy of your spend data and even the safety of the organization could be compromised if your team gets cost centers and GL codes wrong. Here’s how to fully automate the process in near-real time using artificial intelligence.

It’s okay to breathe, now. You’ve got this.

The view from the top: what fully automated GL code assignment looks like

The company was overwhelmed–none of their invoices had an associated PO. Without any context, manually researching and applying the correct general ledger codes to these transactions was costing them time and money. Their existing automation tools weren’t helpful and outsourcing was too expensive. They jumped at the chance to let AI do all the work. AppZen’s Autonomous AP seamlessly integrated with their existing ERP to apply artificial intelligence with deep finance knowledge to their accounts payable process.

In just one, 2-week period, 76% of the company's 1100 invoices

were automatically assigned the correct GL codes, leaving

only a fraction for their finance team to handle.

Altitude headache: manually assigning general ledger codes for non-PO invoices

General ledger account codes are used to describe different types of transactions, to help you track spend across your organization, from broad to granular categories. Without a PO, AP clerks have no idea what an invoice is actually for, whether the company was charged correctly, or whether the goods or services were approved for purchase.

Limited options in procurement and ERP systems force requestors to select a predefined spend category. Guessing the spend category, which drives the GL code, can lead to misclassification. Even using an automation system is no guarantee, as it may also incorrectly code invoices, like assigning an item to the “office supplies” category, when it should be “computer equipment." These systems can’t learn from their mistakes, meaning you have to step in and make adjustments.

While all of this is going on, your invoice goes unpaid, leading to additional problems.

Some organizations will outsource the classification of their spend just to be sure they’re not faced with the consequences of incorrectly-assigned transactions. Those with a high volume of service-based invoices may require additional time to identify line-item levels, spend categorizations, finance taxonomies, and GL codes. All of this leads to late fees, unhappy suppliers, and stressed-out AP teams.

Your oxygen mask: artificial intelligence

More and more finance teams are using the latest artificial intelligence tools to assign spend data classification and GL codes (or Worktags, for those using Workday AP). They’re reaping the benefits of these systems’ ability to quickly and accurately handle large amounts of information. No more outsourcing, manual reviews, or other staffing challenges when scaling up or shifting gears. And the software easily shares information with ERP systems for a smooth handoff.

The AppZen path: how an AI review of invoices works

Although manual matching can be a very human-intensive part of the AP process, there are ways to make it a bearable climb. Scaling up your invoice automation is easy with AppZen’s Autonomous AP solution. Built using artificial intelligence software with deep finance expertise, it understands your processes and can learn your unique AP environment in just a few short months to support every member of your finance team.

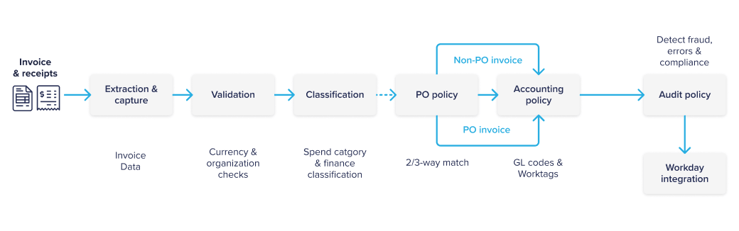

It all begins when your supplier’s invoice is emailed to your AP inbox. Using tools such as computer vision and semantic understanding, artificial intelligence software reads and pulls out the invoice header and other information from the PDF. It then enters that information into the system.

And here’s where AppZen's AI is unique: it knows what it’s reading.

It understands the context of the information and can make intelligent predictions and accurate decisions about what it’s looking at. If it’s not confident that its prediction is correct, it asks you to double-check it. And the answer you give helps it to learn–after just a few examples, it no longer has to ask for your help.

Breathe easier: using AI to accurately predict GL codes

Using an AI-first approach right from the point of extraction, Autonomous AP predicts and accurately assigns cost centers and account codes specific to your chart of accounts (COA), based on your historical coding data and data it has extracted from other invoices. Custom data sets can even be checked to confirm these different segments, using additional information it finds on the invoice, such as an employee ID that maps to a specific location or cost center. And it does it all in near-real time and with 100% confidence.

The AppZen difference

When an invoice first comes into your AP inbox, it's checked for duplicates across all invoices, card transactions, and expenses. It then moves to PO matching and the assignment of GL codes and ensures that all payouts across your systems meet your spend policies. Finally, it enters the procurement or ERP system, all without human intervention. Our intelligent AI software learns quickly and automatically adjusts its predictions based on just two to three data samples of user feedback.

Most invoices move from “extraction” to “ok-to-pay” without you ever needing to touch them, improving your invoice processing efficiency by up to 80%. Our AI also detects and drives down duplicate spending by up to 5%.

Take a deep breath and contact AppZen for a demo today to learn how our Autonomous AP solution can help you. We'll show you how to reach the height of processing volume, save money, and help your company scale that next section of the mountain without the need for additional staff.

BONUS: Questions to ask vendors

Here are some questions to ask when evaluating the best solution for your company:

- Can your solution assign GL codes and cost centers so my non-PO-backed invoices can be validated?

- If a PO is missing from an invoice that requires a PO, can your solution find the correct PO with a high level of accuracy?

- If the PO is missing and your system can find it, can it then predict the correct GL codes and cost centers without my help?

- Can your system self-correct its mistakes, using only a few examples, so it assigns codes correctly in the future?

- Can you show me exactly how your system does all of this?