The e-invoicing mandate for India is finally a reality. Businesses registered on the GST portal are now issuing e-invoices to their customers. This is big news in India, as e-invoicing will not only make government compliance easier, it will also help save time and money. For accounts payable (AP) and finance departments, e-invoicing technology can be a real game changer. Here’s how artificial intelligence (AI) can quickly and easily process e-invoices straight out of your AP inbox.

TL;DR (Too long; didn't read)

No time to study the whole article? Here are the key points:- E-invoices facilitate the required capture of compliance data, needed by both supplier and receiver, for validating returns on the government’s GST portal.

- Government validation of e-invoices helps reduce duplicates, fraud, and disputes between transacting parties.

- The use of AI within your AP automation system increases the efficiency of e-invoice processing with fast, accurate reading, data capture, and validation of QR codes, invoice headers, and line items.

- AP automation that uses AI also allows a validated invoice to be processed all the way to “ok-to-pay” without any additional input needed from you.

How does e-invoicing work?

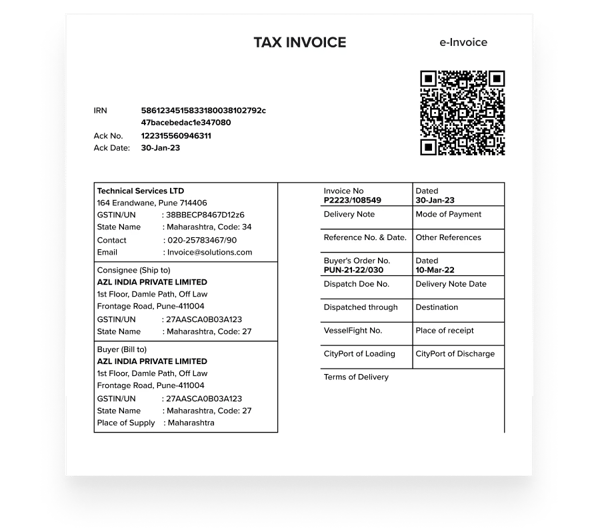

In India, organizations can now generate B2B invoices using a government-approved format. The invoice is then authenticated on the government’s Invoice Registration Portal (IRP), digitally assigned a unique invoice reference number (IRN) and QR code, and returned to the original taxpayer. From this data, government portals also generate e-way bills and populate the GST returns. This comprehensive approach significantly reduces duplicates, speeds up the ITC claims process, and assures taxpayers only genuine ITC is being reported. Failure to comply with India’s e-invoicing rules could result in an inability to claim input tax credits, the detention of goods, and substantial penalties.

How can I use AI to get the most out of India’s new e-invoicing system?

Many companies are turning to AP automation solutions to help them automatically transform all invoices into the new format required by the Indian government. Accounts payable automation solutions come with various features and benefits, allowing you to streamline the e-invoicing process from receipt to approval to payment processing. This saves you time and money while improving compliance with the mandate.

An automation system that employs mature AI models with deep finance training offers even more advantages, such as reducing the time spent on manual processes, eliminating errors, and increasing visibility into the invoicing process.

This new, standardized format includes a QR code containing key pieces of invoice information. Your automation system should be able to read the QR code and verify that the data contained within it matches the information provided on the invoice.

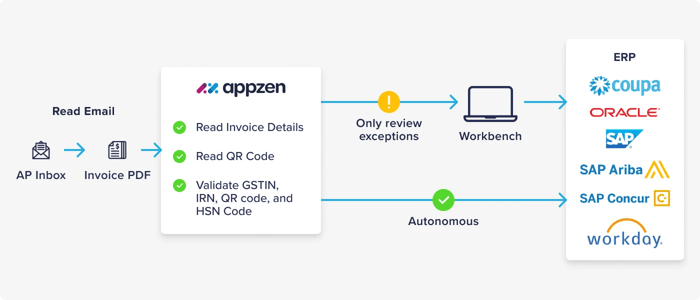

For your receiving AP team to efficiently use e-invoices, your AP automation system should be able to automatically extract key information like the GSTIN, IRN, QR code, and HSN code on every e-invoice. And it should be able to do this whether you receive e-invoices through a vendor portal or by email, without any manual intervention on your part. AI-powered solutions can identify e-invoice documents the moment they enter your AP inbox, and move them through the spend management process quickly and accurately.

AI extracts and reads the QR code, invoice lines, logos, and header. It understands both the content and context of the data and validates invoice data against the data found within the QR code. It then categorizes spend with the correct taxonomy, matches invoice lines against the PO, predicts and enters the general ledger assignment and cost center code, and audits 100% of all e-invoices before payment.

Your AP automation solution should also automatically validate all of the key pieces of information contained within the QR code to ensure each invoice’s authenticity. It should quickly scan the QR code provided to retrieve data with accuracy and speed, validating vendor details such as name, GSTIN, and IRN. This minimizes disputes between transacting parties when processing e-invoices, and helps you align with the compliance requirements set forth by the government when filing returns.

What e-invoicing questions should I ask my AP automation provider?

There are a number of automation systems that can assist you in creating and reading e-invoices. However, an AI-first automation system can provide your AP team with maximum processing speed, efficiency, and accuracy, taking invoices from your AP inbox all the way to “okay-to-pay” while also meeting India’s regulatory e-invoicing compliance requirements. Be sure to ask your solution provider exactly how their system works with regard to India’s e-invoices. Here are three important questions to ask:

- Can your system read and validate all of the information found in the QR codes on India’s e-invoices?

- Can it read documents straight out of my AP inbox without me having to sort through my emails, download e-invoice documents, and transfer them to your system manually?

- Once an e-invoice has been validated, can your solution continue processing the invoice without the need for me to check the data at every step? If not, how much additional work will I have to do?

Not getting the answers you were hoping for?

If you’re not getting the answers you want, perhaps you need to keep looking. An integrated AP automation solution like AppZen’s Autonomous AP can seamlessly process e-invoices received from your suppliers, whether they arrive in your supplier portal or AP inbox.