Imagine a self-driving car asking the driver at every intersection which way it should go or whether the road is clear. This is not very useful...and not really self-driving. However, this is precisely what happens every day in the Finance Department with many IT applications.

Despite years of technological enhancements, finance teams still face systems asking if the data extraction has worked correctly or whether coding looks right. But wasn’t taking that off your hands the reason your team bought into these technologies in the first place?

Thankfully, this is changing. Autonomous finance systems create the finance equivalent of a driverless car — tools that know what they are doing and that will only ask if they need help. If they don’t, they will just get on with it.

So how far away from autonomous finance systems are we?

The journey to autonomous systems will require significant advances in technology and a shift in how the finance team works with technology. It is unlikely that Finance will move in one leap from whatever level of automation they currently have to a fully autonomous system — it’s just too far to jump. But progressing towards autonomy in a series of smaller hops is much more realistic. Organizations need to clearly understand the various levels of autonomy available, the improvement that moving between levels will bring, and what is required to progress to higher maturity levels.

To help them achieve this, we use the Autonomous Index.

The Autonomous Index

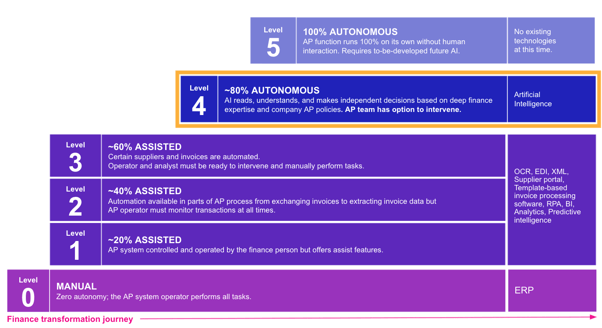

The Autonomous Index is a framework that defines the six levels of autonomy, from Level 0, with no autonomy, to Level 5, with fully autonomous operation. The Index acts as a benchmarking tool for organizations to establish their level of autonomous maturity, and understand the roadmap for future investment and improvements within their department.

As the organization’s requirements grow, the functional burden they place on their systems also grows. At each stage, there are telltale signs that it is time to mature. Perhaps supplier relationships are being stretched due to late payments, or the AP team can’t process invoices fast enough. These signs indicate a need for a higher level of processing capability and a readiness to move up a higher level of autonomy.

Level 0: No Autonomy

Long ago, we had an entirely manual approach for all finance processing. We call this Level 0: the starting point. At Level 0, everything requires manual entry — an operator must visually look at each incoming invoice and key in the data for every supplier name, invoice number, and financial value. Level 0 is incredibly time consuming and error prone.

Any finance department that has been around for more than ten years started here. What is worrying is that some AP departments are still here.

It’s not that CFOs and their teams in these departments cannot see the benefit of automation, it’s just that they’re not sure where to start. Shifting away from Level 0 is a BIG change. Moving from entirely manual systems to simple automation is a culture shock; it requires financial investment and a mental and philosophical commitment.

Levels 1 through 3: “Assisted” Automation

Once organizations make that leap, they start seeing benefits.

Simple automation begins to appear in Level 1 organizations. Level 1 offers the finance equivalent of driver-assist features in a car, such as cruise control. The team is still in complete control of the process at Level 1, but some automation assists. This assistance could be providing checks on entered values, tax rates, calculations, and potentially referencing supplier databases or PO systems during the AP process. To facilitate this, specific tools are introduced:

- OCR to extract values from images

- RPA to enter invoice information

- EDI and XML to integrate between the partners you supply for invoice entry, using API integration and automated interfaces

Overall, the operator still controls the system but specific tasks or portions of the processes are automated. This simple automation assists the operator but does not significantly benefit their productivity.

Level 2 steps things up. At this stage, we see automatic data extraction from incoming manual invoices and e-invoices, data-level integrations to the ERP system facilitating payments, and processes that are much more digital. However, the operator still needs to monitor these activities and ensure accuracy and validity at all times.

Once an organization reaches Level 3, it functions with best practice and best-in-class scenarios, where some part-processes are fully automated. Level 3 is the current pinnacle of automation. However, there is still a need for human intervention, with operators performing some tasks manually and ready to step in at any point, if required.

Progression through these three stages of automation does not necessarily see new tools added, but as you work up from Levels 1 to 2 to 3, the technologies provide more and more assistance.

There is a very obvious glass ceiling here. Even with Level 3 technology and processes in place, we still see finance operators reviewing information to make sure it has been correctly processed, making changes when necessary, and monitoring for timeliness and completeness.

The challenge is in getting beyond 60 percent automation. There are so many exceptions, so many variations, and the automation remains fundamentally rules-based.

Levels 4 and 5: Autonomous Systems

Levels 1 to 3 attempt to automate each step in the finance process. This could be through using OCR and AI to automate the extraction and capture of invoices and the data on them, for example, or through using RPA to pass data from the AP system into the ERP system for payment.

Each of these tools tries to refine and optimize one particular part of the overall process. And they can work well in select areas, such as the extraction and matching of PO-based invoices from suppliers with simple and unchanging invoices. But in other areas, such as GL and accounts coding, these technologies are woefully inadequate.

Autonomy flips this concept on its head by working across the WHOLE process.

Consider an autonomous accounts payable process. Improvements occur immediately, from silently intercepting documents in a non-invasive manner, applying the best AI, and autonomously approving most transactions, to alerting the finance team of exceptions. Here, autonomy dones not make the individual pieces of the process top notch, but rather aims to make the whole, end-to-end process world class.

That is a big difference that organizations can only achieve by adding artificial intelligence (AI) to the mix.

To do so, AI must be applied across the whole process in a connected manner; it is not focused on only specific parts of the procedure. Various areas of the AP process, for example, can benefit from AI, such as invoice capture and data extraction. However, for true autonomy, we need to extract data and understand it in context.

Automation does not attempt to understand, it simply tries to process as quickly as possible based on simple rules. Autonomy, on the other hand, understands what a supplier invoice looks like, what data it should contain, how that relates to the supplier master, what contractual terms exist with that supplier, how those supplier invoices have been processed, validated, and coded in the past, and what, if any, approval issues may exist on the invoice.

Doing all of this in a seamless, connected manner, using self-correcting AI that gets better every time it operates, provides the platform for autonomy.

There is one big challenge, however. At the top of the index is Level 5, where currently no technologies exist. That is because Level 5 indicates 100% autonomy — a scenario where zero human input is required. This is still some way off, but Level 4 autonomy exists today, using AppZen technologies, where AI reads, understands, and makes independent decisions based on deep finance expertise and company policies.

Level 5 is not here yet — but it is the north star aspiration for the most thoughtful teams and technologists.

Conclusions

For finance departments, the execution of invoice processing has not changed significantly for many years. Automation has helped at certain stages of specific processes such as AP and purchasing, yet most existing automation technology cannot replicate nuanced human decision-making — meaning that the continued need for human supervision often outweighs any improvements.

To move beyond this stalemate, something radical is required.

Instead of automating individual pieces of the process, autonomy attempts to provide the equivalent of a self-driving car, making the whole process autonomous. By rethinking end-to-end finance processes and focusing on ultimate goals rather than individual steps, autonomy has the potential to change finance within organizations forever.

The Autonomous Index clearly helps identify where an organization currently sits and helps benchmark its current level of autonomous maturity. For those CFOs looking to drive their finance departments into the future through integrated, intelligent technology, the Autonomous Index provides a clear roadmap to success.