Expense Audit

De-risk T&E, stop wasteful spending

The leader in finance AI, auditing every expense report in every language, every country, 100%

“The reason that we wanted to go with AppZen was the ease of use and implementation alongside [our EMS]. We had a lot of things missing in our process, and things like finding duplicates couldn’t be done by our team alone. AppZen has completely changed the way we audit, now.”

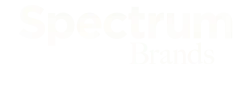

Recognize suspicious spend, mistakes, and fraud immediately

Automatically flag non-compliant spend and potential fraudulent activity using AI that understands receipt data, external online sources, aggregated spending over time, and your history of violations.

Catch duplicates across all spend

Eliminate duplicate expenses using AI that matches receipts with expense reports, cards, and invoices. Our proprietary AI finds duplicates across your spend, including similar receipts, multiple expense report submissions, card transactions, and invoices, saving you money immediately.

Rein in foreign expenses

Audit and identify unauthorized purchases in 42 languages and 97 countries. Our AI simplifies global spend transparency and country-specific compliance.

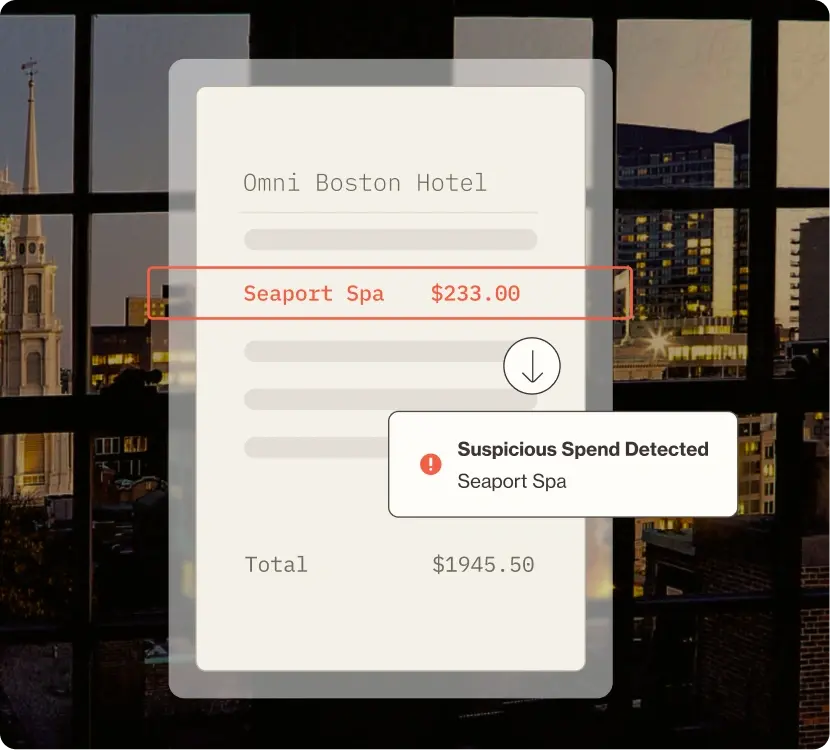

Industry and regulatory compliance, built-in

Stay up-to-date on current regulations such as FCPA, the Sunshine Act (HCP), detecting politically exposed persons in attendees, and fapiao compliance for China, all built-in and extensible.

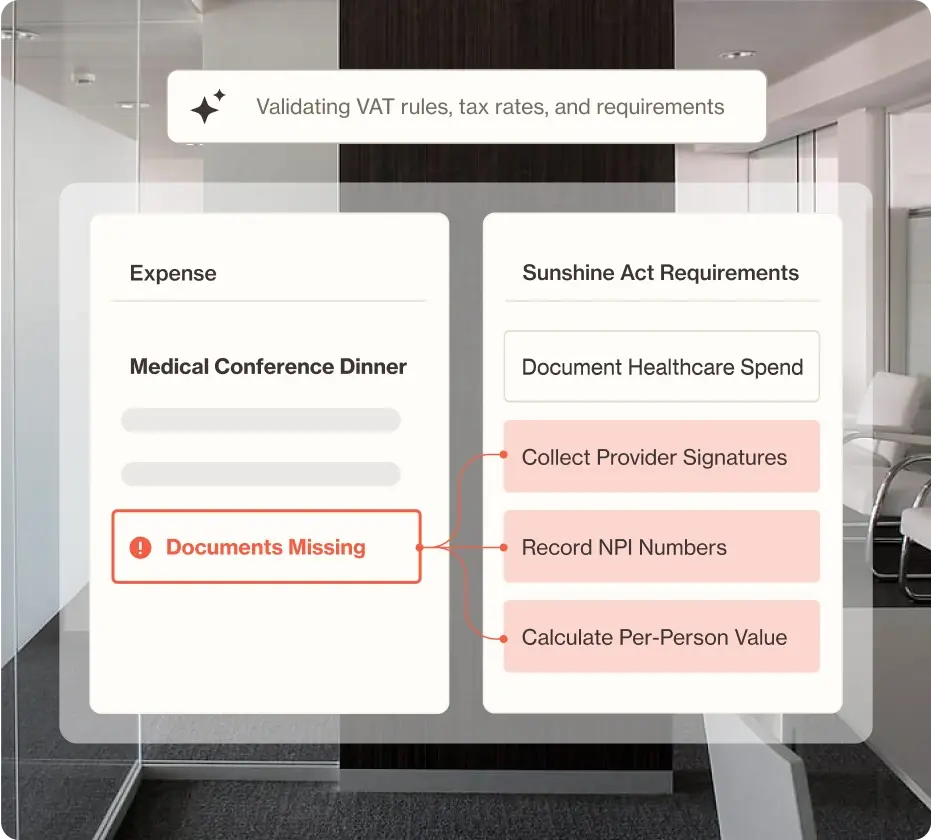

Save time with Smart Workflows

Set up automated workflows that route high-risk exceptions to managers and track resolutions. With Smart Workflows, managers move from “rubber stamping” expense reports to smart approvals.

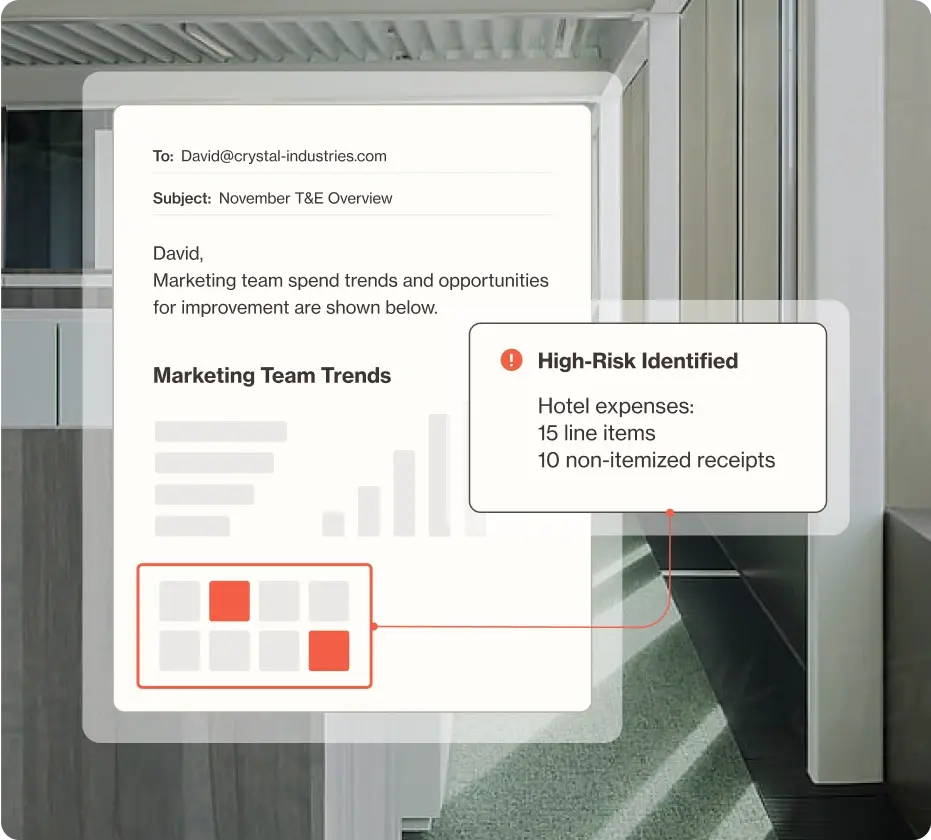

AI Analytics for finance teams and managers

Prescriptive analytics made for line managers offer insights to evaluate policy improvements and coach employee spend behavior. Review expense data alongside detailed suggestions based on your historical transaction patterns.

Amplify your T&E team with AI Agents

Deploy AI Agents to automatically review expenses, flag risks, and take action on what needs attention, ensuring automated compliance. AI Agents complement your T&E team by automating 50% of their tasks.

Our T&E integrations

Seamlessly connect with leading expense auditing systems and card providers to get up and running quickly.

Optimize your T&E team

with Mastermind automations

Other Expense Audit capabilities

Credit Card Activity Check

Audit card spending directly from your company's bank records.

Allowable Alcohol Check

Compare the alcohol charges on receipt lines with allowable thresholds.

Blocklisted Merchant Detection

Prevent potential issues by reviewing flagged expense report lines from high-risk merchants.

Conflicting Expenses Tracker

Identify expense reports with costs that don't align, such as meals and per diem.

Duplicate Expense Across Reports

Look up historical reports to automatically flag when a duplicate receipt has been submitted.

Healthcare Professional Check / Sunshine Act

Identify healthcare professionals on expense claims by verifying event guests and connected line items.

Personal Expense Detection

Track charges marked "for personal purposes" or those not seeking reimbursement.

Fapiao Validation

Verify the presence of fapiao fields and adherence to the standard format for legal proof of purchase receipts.

Customer stories

FAQs

01 How does AppZen’s AI work?

AppZen’s AI technology acts as a 24/7 automated finance expert that reads, extracts, and understands the content and context of every receipt line. Our AI combines this data with intelligence from thousands of verified sources to validate expenses, detect policy violations, and identify high-risk transactions while automatically approving low-risk spend to make the expense audit process more efficient.

02 How can AI be used for expense auditing?

AppZen’s AI automatically audits 100% of expenses by analyzing receipt data, validating merchant information, and checking for policy compliance. AppZen performs multiple checks, including receipt itemization verification, duplicate detection across reports, and merchant price validation, and monitors for unauthorized expenses. In addition, AppZen conducts anti-corruption and healthcare professional compliance checks to ensure comprehensive auditing coverage.

03 What is audit review in AppZen?

It is an automated process that examines every line item of expense reports using custom-built AI models for comprehensive verification. AppZen matches receipt lines against expense claim lines, identifies miscategorized expenses, and flags high-risk transactions while auto-approving low-risk spend.

04 How does Expense Audit prevent compliance issues and fraud?

AppZen uses AI to prevent compliance issues and fraud by automatically checking every transaction against anti-bribery regulations, FCPA requirements, and Sunshine Act compliance. AppZen analyzes receipt data and cross-references it with external databases to identify high-risk merchants, unauthorized expenses, and suspicious patterns, helping organizations catch policy violations before payment occurs.

Request a Demo

Ready to rethink what’s possible for your finance team?

AppZen is changing how businesses control their spend and budgeting.