Our ongoing “Did you know” series highlights the capabilities and benefits of AppZen Expense Audit, bringing you deeper into what makes it tick and how you can take advantage. In this post, we look at tracking expense compliance by employee.

Work-from-home is blurring the line between “business purpose” and “personal expense.” Typically, only 5% of employees commit 90% of the expense violations, yet most companies are unable to control these repeat offenders. They often take advantage of gray areas in the corporate expense policy. Is a weekend evening cocktail after a long day of work at home legitimate, because an employee feels they have earned it? Or is it an expense policy violation?

Most managers would say if an employee worked on an occasional weekend and rewarded themself with a cocktail or dinner they would probably approve of it, especially if there is no overtime and the employee is not taking a weekday off to compensate.

Repeat offenders, however, are a very real problem in expense policy compliance. Some employees are motivated by the thrill of bending the rules without getting caught and feel that “gaming the system” confirms their intelligence. Some don’t see what’s wrong with rewards such as travel upgrades, alcohol, or a spa visit that they think they deserve.

Repeat offenders may feel that they will not be discovered, as finance systems lack the intelligence to uncover trends in their spending behavior. They may claim they did not understand the policy and suggest that, had they been notified sooner, they would have not taken the objectionable action. They might also try to find different, unrelated “grey areas” where the policy can be interpreted in their favor.

These employees may feel they are in important departments or positions in the company and rationalize that it’s not an issue, even if they get caught once, as they can explain it away with a legitimate-sounding excuse. They may not think that the Travel & Expense managers and auditors have sufficient power to affect their behavior.

However, they often underestimate the impact on their own career when the manager, director, and vice president see a report showing multiple violations committed by the repeat offender. Nor do they consider the impact of those violations on their manager or their team.

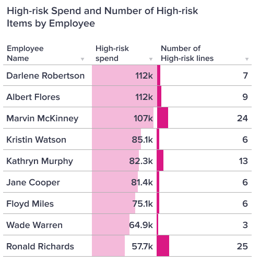

AppZen’s Mastermind AI helps finance auditors zoom in on repeat offenders by reporting their expense behavior. Once identified, the situation can be escalated to management for further action, such as policy training, ethics refresher courses, a warning, or even payroll deduction. AppZen’s dashboards help front-line managers track compliance at the employee level, and can also be used by directors and executives for aggregate violations and trends within their teams. This is a useful change management lever, enabling supervisors to warn and hold their direct reports accountable.

AI-powered insights identify employees with the most missing receipt affidavits or high-risk reports, so managers can tackle the root of the problem.

What’s more, AppZen enables each of our customers to create a unique index for monitoring an individual employee’s expense behavior and track changes over time. This helps finance auditors identify individual employees whose behavioral profile signals non-compliance and target them for behavioral change programs. The key to doing this right is to do it in an unbiased manner by implementing automatic controls that identify challenging employees without bias.

Wondering what else AppZen Expense Audit can do? Check out AppZen Expense Audit on the web, or reach out!