Here’s your AI-fake receipts defensive playbook

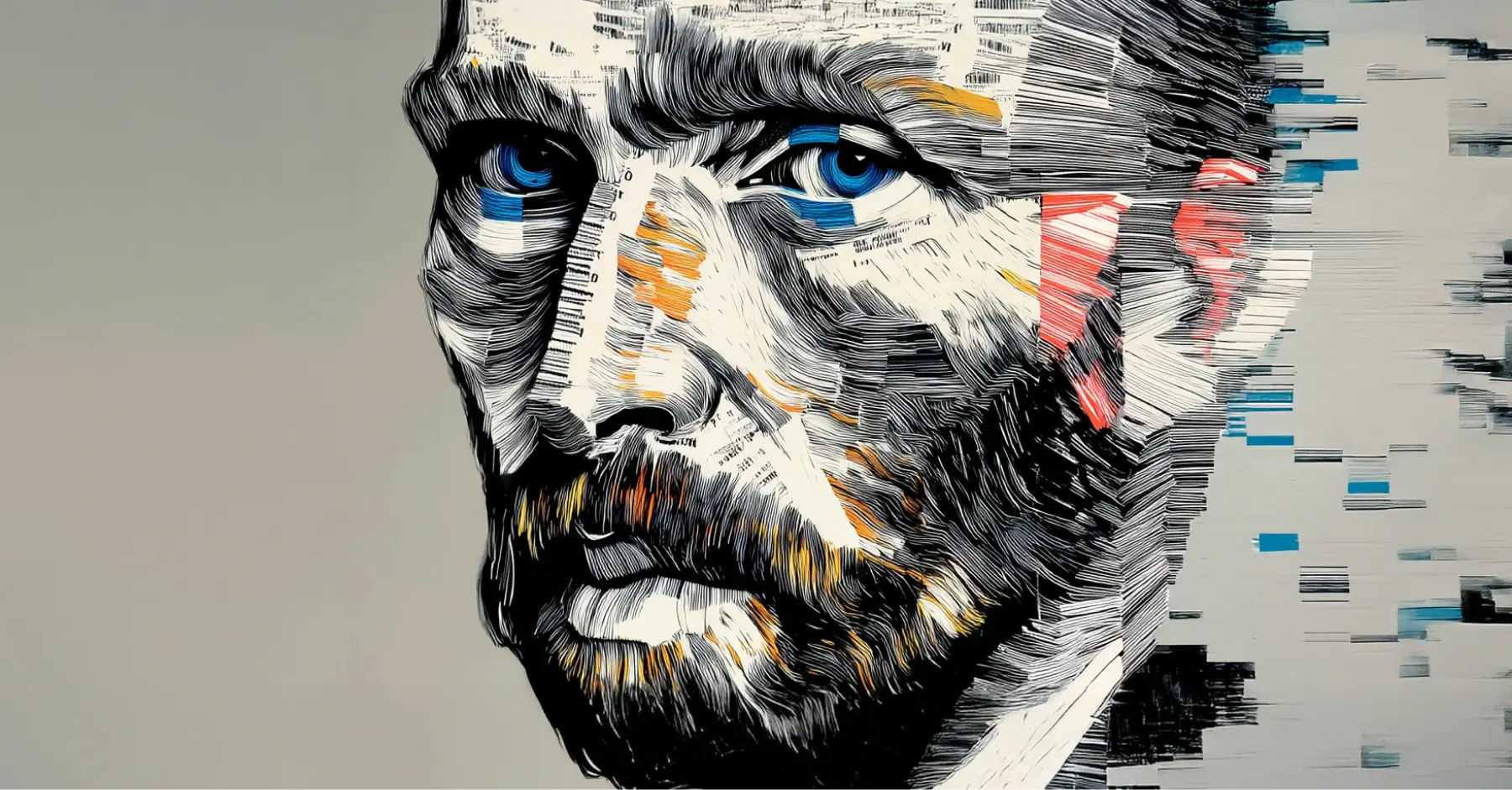

The art of fraud: An expense audit perspective In 1976, an unassuming German artist named Wolfgang Beltracchi began painting works “in the style of” long-dead masters like Max Ernst and Heinrich Campendonk. His forgeries were so convincing that...